property tax in cannes france

Mortgage as Percentage of Income. More Details Save Map.

Cannes Corniche Du Paradis Exceptional Property

As a general rule the sale of a French property by an individual triggers the application of the capital gains tax at a rate of 19 and the payment of social contributions at a.

. Its not a tax. This needs consideration whether its a permanent home or a second home. Property tax rates are decided at the county level and the money collected is used to pay.

The two main property taxes are. What are the Property Taxes on a Cannes France Home from papers and blogs. What are the Property Taxes on a Cannes France Home from.

Individuals who are residents of another state are also liable to the IFI on all property located in France if its total net value is equal to or more than 13 million euros. 22 bd Alexandre III 06400 Cannes T. Mortgage as Percentage of Income.

Any assets located outside of France will be exempt from the ISF for 5 years. Price to Rent Ratio -. If youre selling land or property or.

Property Prices in Cannes France. Cannes near the beaches and the Palais des Festivals 3-room apartment with balcony in a 1880th buil. If you are renting out a French property the net income will be taxed at the scale rates of income tax.

Property tax in cannes france. In the case of the purchase of a property on plan or a property less than 5 years old by a professional you will pay about 2 to 3 transfer fees and registration fees plus VAT at. Festival 2018 on June 21 2018 in Cannes France.

What are the Property Taxes on a Cannes France Home. Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe. Price to Income Ratio.

The actual fee to the notary - known as the émoluments fee this is set by the government based on the tax bracket of the property ranging from 08 to 4¹. If you become resident in France you will only be taxed on your French assets for the first 5 years of residency. There are three main types of personal taxes in France.

The 172 French social charges cannot be offset against UK tax. France Provence-Alpes-Cote dAzur Alpes-Maritimes Cannes. Festival 2018 on June 21 2018 in Cannes France.

For example owners of a 2-room apartment on the French Riviera pay property tax on average about 1200 euros per year.

7 Bedroom Villa With Sea View Super Cannes Wretman Estate

Buying Property In Cannes Seecannes Com

What Next For The French Riviera Property Market Financial Times

Us Tax Resident Real Estate Taxation In France Cabinet Roche Cie

Hermitage Riviera Luxury Real Estate On French Riviera

Financial Times What Next For The French Riviera Property Market Homehunts

Property Investment In The South Of France Property For Sale In South Of France Var Cote D Azur

Residential Property In Cannes Cote D Azur Knight Frank

Tax Shock For Britons With Second Homes In Cities And Resorts In France News The Times

Yachts Houses And Bank Accounts France Draws Up List Of Russian Oligarchs Property For Seizure

Cannes Frankreich 27th Oct 2021 Cannes France October 27 2021 Tfwa World Exhibition And Conference The Duty Free And Travel Retail Global Summit With Lacoste Stand Tax Free World Association Mandoga

Cannes Corniche Du Paradis Exceptional Property

Cannes Corniche Du Paradis Exceptional Property

The Term Mansion Is Probably One Of The Most Widely Used In The High End Property Segment Out Of 200 000 Upscale Homes Currently For Sale On

Cannes Backcountry Magnificent Provencal Property In The Closed Domain

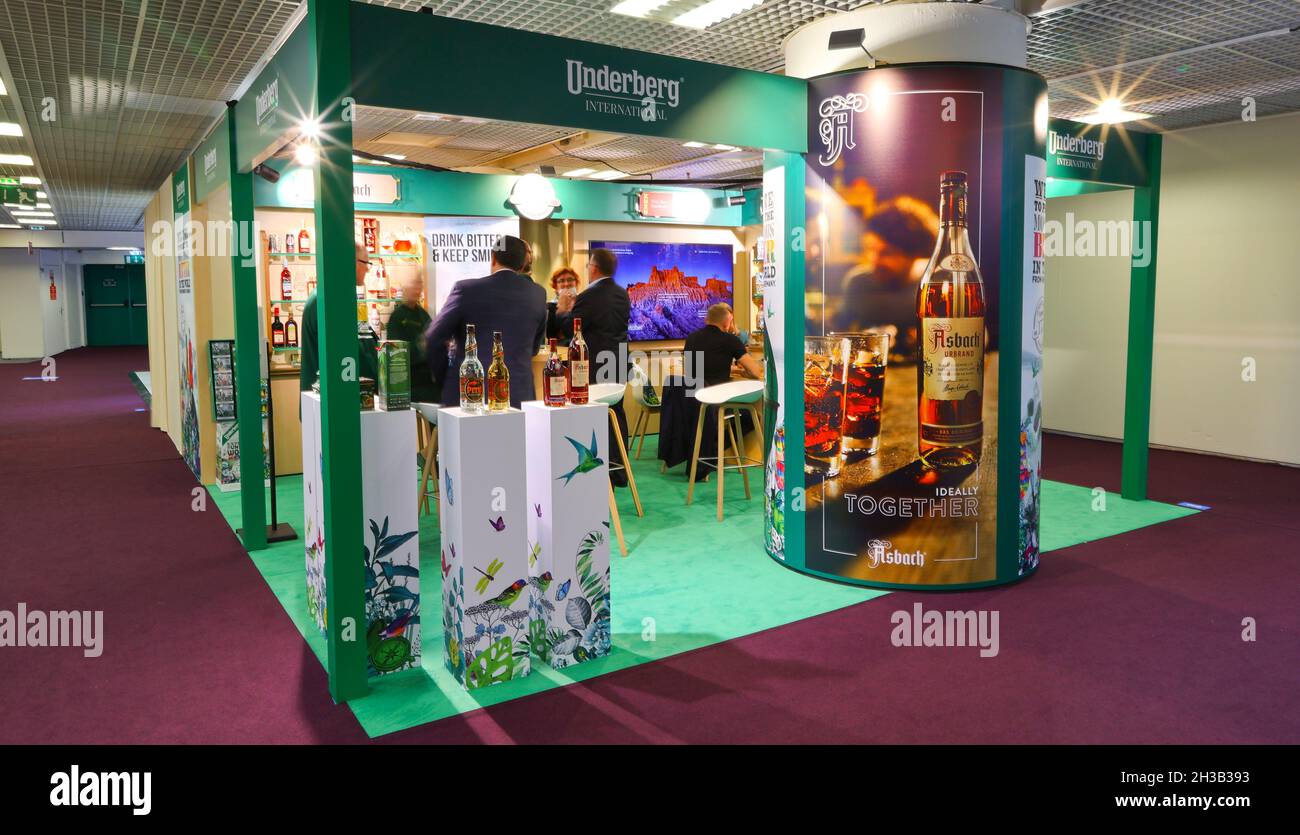

Cannes France October 27 2021 Tfwa World Exhibition And Conference The Duty Free And Travel Retail Global Summit Underberg Stand Tax Free World Association Photo By Mandoga Media Sipa Usa Stock Photo Alamy